Nymbus Results You Can Take To The Bank

GOALS: Increase the number of opened and funded accounts for ZYNLO Bank, the digital branch of PeoplesBank.

CHALLENGE: Tracking clarity and effectiveness. Media performance measured on a different platform than conversions, creating critical gaps in marketing intel.

Lead acquisition and paid media strategy can transform a company’s bottom line in extraordinary ways — as Nymbus and ZYNLO quickly discovered after partnering with Starmark.

Show Me The Money!

Nymbus is a builder of digital banks: they empower financial institutions of any size to quickly launch a full-service digital bank or migrate to the Nymbus award-winning core, engaging and supporting the full digital customer journey.

Starmark’s partnership with Nymbus began by supporting ZYNLO Bank, one of their clients. ZYNLO, a division of Peoplesbank, is the digital version of the bank’s brick & mortar institution.

ZYNLO was already measuring ad impressions and clicks, but wasn’t able to track from the initial click through to account opening and deposit. Their metrics at the time weren’t revealing what the digital bank’s leadership needed to know. How many of those impressions and clicks led to cash in the bank?

Another big question: WHEN were those conversions happening?

Since new ZYNLO bank application submissions were recorded on a separate platform from its ad metrics, the siloed reporting structure left a big data gap. Even when a successful conversion occurred, management wasn’t sure which specific ad effort drove it. This hindered their ability to optimize campaign strategy and spend.

A New Point Of View

Starmark closed these data transparency gaps through several approaches. We implemented Google Analytics 4 conversion tracking, identifying a new application submission whenever a customer entered their address, as well as UTM parameter tracking allowing us to map back funded accounts and balances to the media channel.

Starmark then created a customized dashboard allowing the client to access performance data 24/7 for paid media campaigns, as well as organic search, organic social and email campaigns.

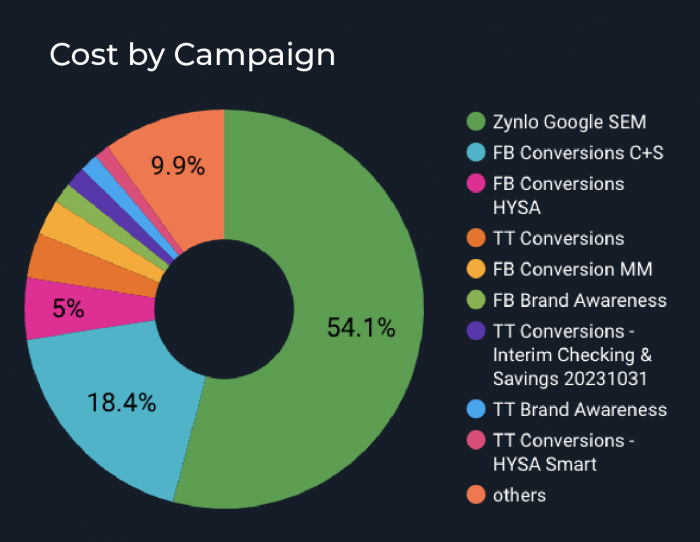

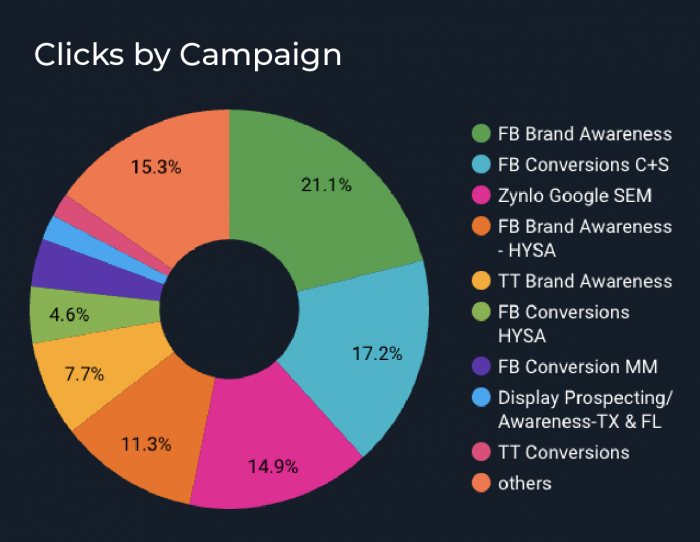

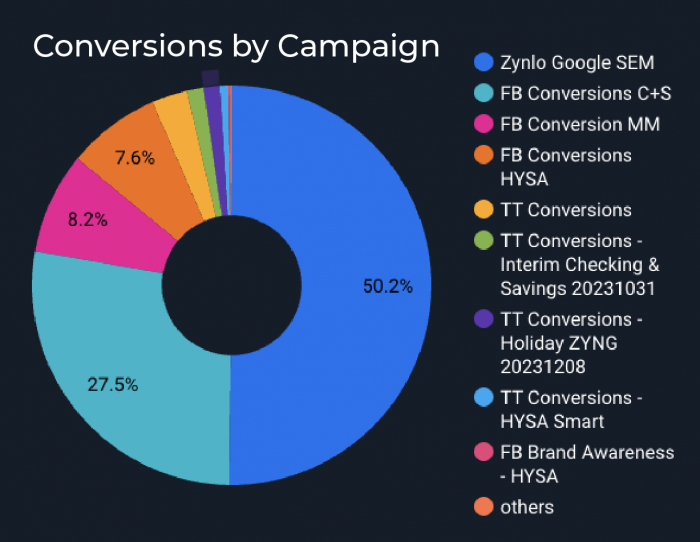

Campaign Breakdown, Cost, Clicks & Conversions

On the media strategy side, Starmark launched campaigns on SEM, Meta, TikTok, YouTube and Programmatic Display. Then added SnapChat and most recently Programmatic CTV. Initial geo markets spanned Texas, California, Florida, then expanded into five additional states.

Results? You Bet Your Bottom Dollar!

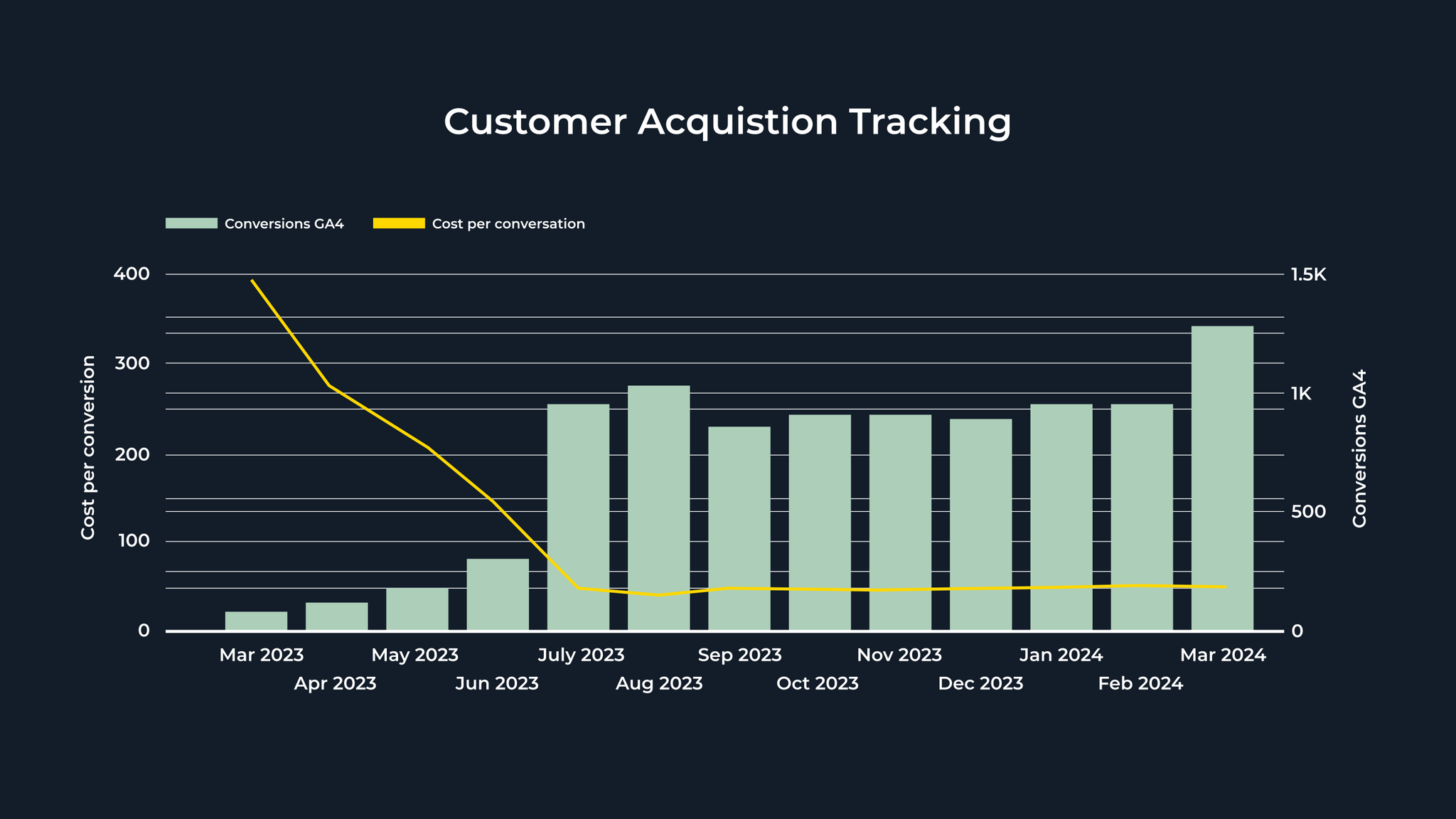

Through fine-tuned media strategy and channel tactics, as well as enhanced down the funnel tracking implementation, Starmark reduced ZYNLO customer acquisition costs while boosting new funded accounts and customers.

Starmark has certainly exceeded expectations because we work together as true partners. Applications and new accounts really ramped up. The depth of analytics that we now have has allowed us to set thresholds for success, forecast expectations, and justify incremental spend and geographic expansion.

— Brittny Williams, First VP, Digital Growth, PeoplesBank

Campaign Performance

The Interest Keeps Compounding

Starmark’s track record and rewarding partnerships within the digital banking sector continue to expand, as more banks leverage our expertise in acquisition, media and creative strategies.

It’s been so gratifying to track the substantial gains ZYNLO has enjoyed these past few months — and it’s getting even more exciting, as we build similar wins for all our banking clients.

— Nathalie Dupont, VP, Digital Strategy

If you lead a credit union, bank or financial institution, discover stronger, more profitable media and data strategies you can bank on! Reach out to our Starmark experts now.